Who said it would be easy? Market jitters? Keep your cool by staying focused on long term objectives (Feb 2020)

Common mistakes in investing costs money. Ultimately, they reduce the value of assets. We have come across people over the years who, on their own initiative, due to not be able to keep their cool during market stress switched their assets into cash waiting for the markets to calm down. We have also come across people who although they moved their assets into cash (during the 2008 credit crisis) after that they forgot to switch back into the markets missing out substantial gains. Such positions are acceptable provided they are based on tactical investment decisions.

It is very important to know and remember at all times what is you are investing for?

A well thought out financial plan answers this question since it has already taken into account lifetime objectives, time horizon and risk tolerance. Market fluctuations are part of the journey.

Investors Often Misunderstand Risk & Return. Although risk and return are two of the most commonly used terms in an investor's vocabulary, their definitions can often be unclear. History has shown that investors have not been taking the idea of risk as seriously as they should, and they have been overexposing themselves to equities. Moreover, they have not learned from past mistakes or mistakes of other people.

The following will define risk and return both in terms of best practices and in real world application.

Return

Best Practice: The asset's expected annual rate of return on investment.

Common use: Often, a financial adviser/investor using the term "return" will be referring exclusively to the price history of an asset, rather than its expected rate of return in the future. Historical price is at best a dangerous proxy for predicting the future.

Risk

Best Practice: In simple terms, it is the variability of the expected return (either up or down) over your investment period. However, a given level of variability (risk) today or in the past may not be representative of the future. This has been the case in 2008 and during the period 2000-2003 where risk in the worlds markets had increased.

Common use: Often, investors understand the term "risk" as knowing that investments can go down or lose money. This generalisation of risk, so prominent in the industry, requires several assumptions.

An investor must assume that the following risk attributes will be present in the future in the same or different proportions and magnitudes:

Investment Risk, Sequence of Return Risk Market Risk, Credit Risk, Business Risk, Currency Risk, Political Risk, Country Risk, Interest Rate Risk, Liquidity Risk, Counter-party Risk, Legal Risk and so on. There are other types or risk as well.

However, the concept of risk is something with deal with every day, in every aspect of our lives. Crossing the road, driving a car and so on, but that does not mean there is anything wrong with them. Through this article, it is our aim to help you recognise common investment mistakes and provide insight on how to avoid them.

Here are some reminders to help keep your cool:

- The goal of investing is to gradually build wealth over an extended period of time to meet lifetime objectives

- Investing takes a long-term approach to the markets and often applies to such purposes as retirement pension funds and other investments such as ISA's, SIPP's, Collective Investment Accounts and others

- Investments often are held for a period of years, or even decades, taking advantage of benefits like interest, dividends, along the way. While markets inevitably fluctuate, investors will "ride out" the downtrends with the expectation that prices will rebound and any losses eventually will be recovered. At least, history has shown that

- Since the goal is to grow assets over the course of decades, the day-to-day fluctuations of different investments are less important than consistent growth over an extended period.

- TIME HORIZON IS VITALLY IMPORTANT. People are saving for a long time and withdraw money in retirement for a longer period since life expectancy has increased. As such, asset allocation to growth volatile assets is important to enhance future wealth and support income withdrawal during retirement

- Aligning your portfolio strategy with your objectives is a critical factor in determining long-term investing success. This may sound obvious, but many investors actually employ strategies that work against their objectives. A common error investors make is misjudging risk. The longer the investment time horizon, the more risk one is able to take on. Typically, however, many investors do not take enough risk. They focus on short-term volatility rather than on the long-term probability of achieving their objectives

- So before the market goes down be sure that you remember your lifetime objectives and tolerance of risk and your financial plan is designed to match it

That is why, it is vital we create an environment for investing that is detached from emotion, one that relies on personalised advice and data and impartial analysis to make the right decisions for your financial future as well as strategic & tactical asset allocations based on your objectives and market conditions.

When doing nothing is best

From time to time, stock markets go through periods of uncertainty. This could be down to some poor economic news or perhaps due to a political crisis, for example, the 1970’s oil crisis, the 2000-2003 internet bubble and the 2008 credit crisis and so on.

The sharp falls that can be experienced at such times are understandably unsettling for investors. They can even tempt some to change their long-term plan by selling their investments. However, stock market volatility does tend to be short lived. Therefore, most experts agree that investors are probably better off sitting tight through these unnerving periods.

Those who sell or delay making new investments when stock markets become uncertain are actually employing a strategy known as 'market timing'. The intention is often to invest once stock markets have calmed down or to buy when stock markets have gone even lower.

Sharp falls in stock markets tend to be concentrated in short periods. Similarly, the biggest gains are often clustered together. It is also quite common for a large gain to follow a big fall (or vice versa).

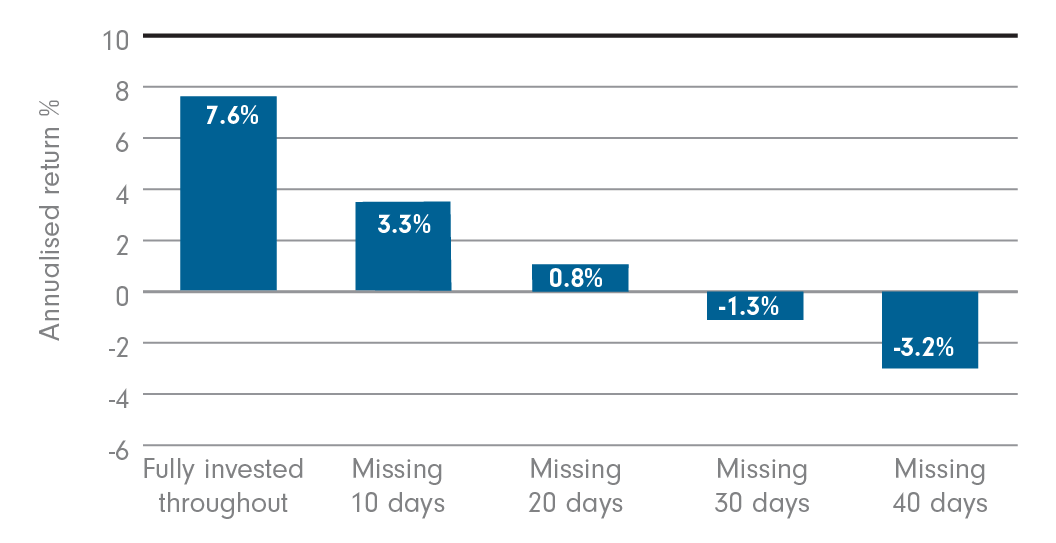

To help illustrate this, Fidelity Investments have analysed the average annual return from the UK stock market over the last 15 years. As the chart shows, missing just the ten best days over this period would have cut your annual return substantially. Timing the stock market is extremely difficult, the best policy is usually to stay fully invested over the long term.

FTSE All Share Index: Effect of missing best days

Source: Datastream from 31.12.04 to 31.12.19, annualised return | Returns based on the performance of the FTSE All-Share, with initial lump sum investment of £1,000 on a bid to bid basis with net income reinvested

- When stock markets become volatile, it is usually best to resist making changes to your long-term investment strategy.

- It is too easy to miss the best gains when you try to time the stock market.

- Time, not timing, is the key to investing.

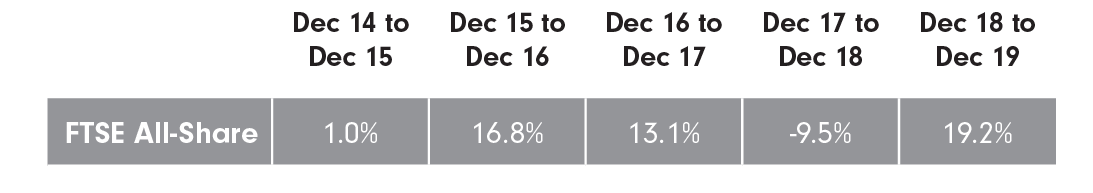

FTSE All Share Index

How the index has performed over the last five years

Source: Datastream from 31.12.14 to 31.12.19, on bid-bid basis with net income | Please note that past performance is not a reliable indicator of future returns. The value of investments can go down as well as up, so you may get back less than you invest.

The value of advice

This information is not a personal recommendation for any particular investment. When making decisions about investing, we spend considerable amount of time teaching our clients the important principles of investing before we design their asset allocation and investment policy. We work very closely with our clients so we understand their needs and, then offer tailor-based advice to help achieve their long-term goals.