portals guide

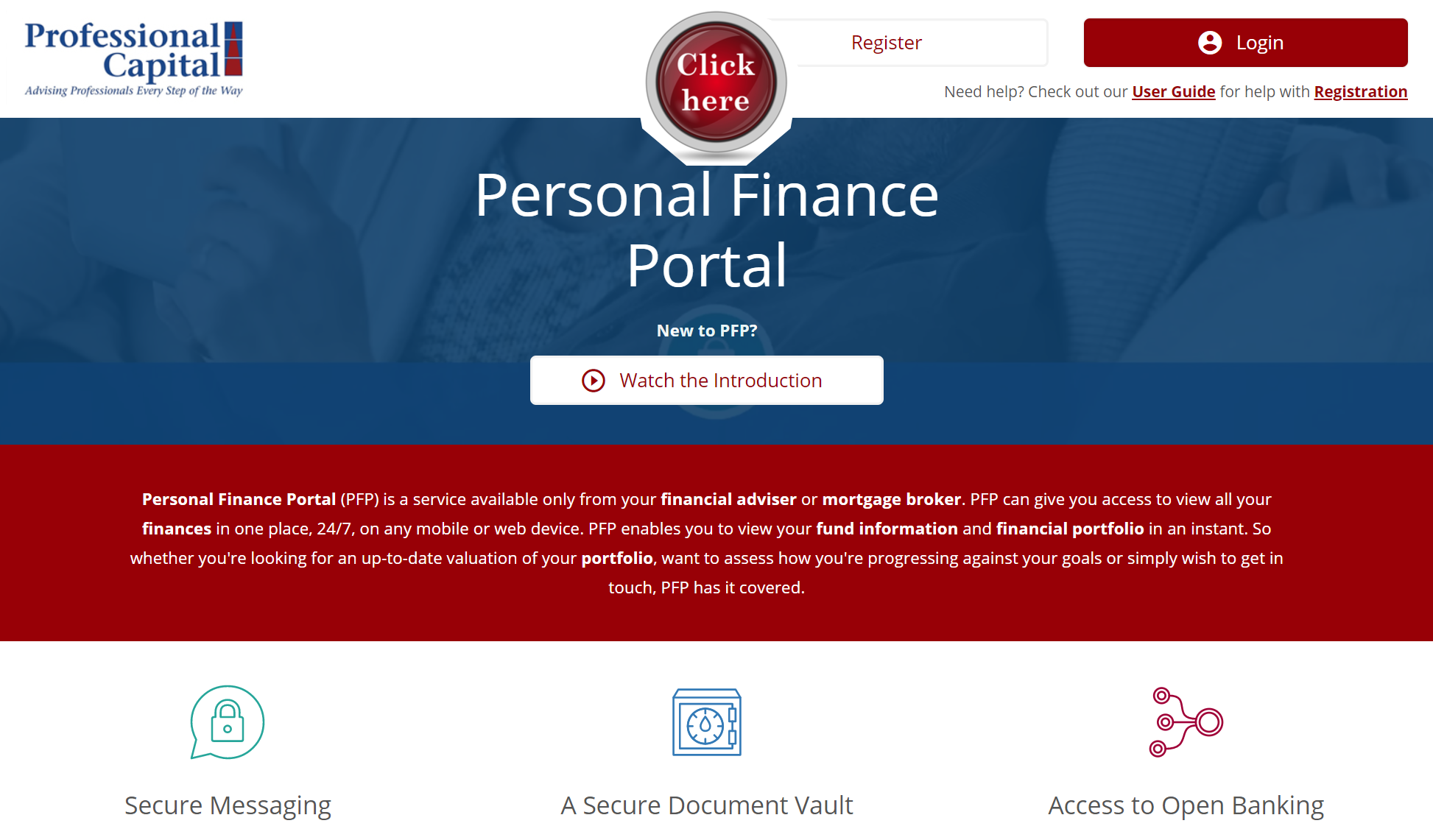

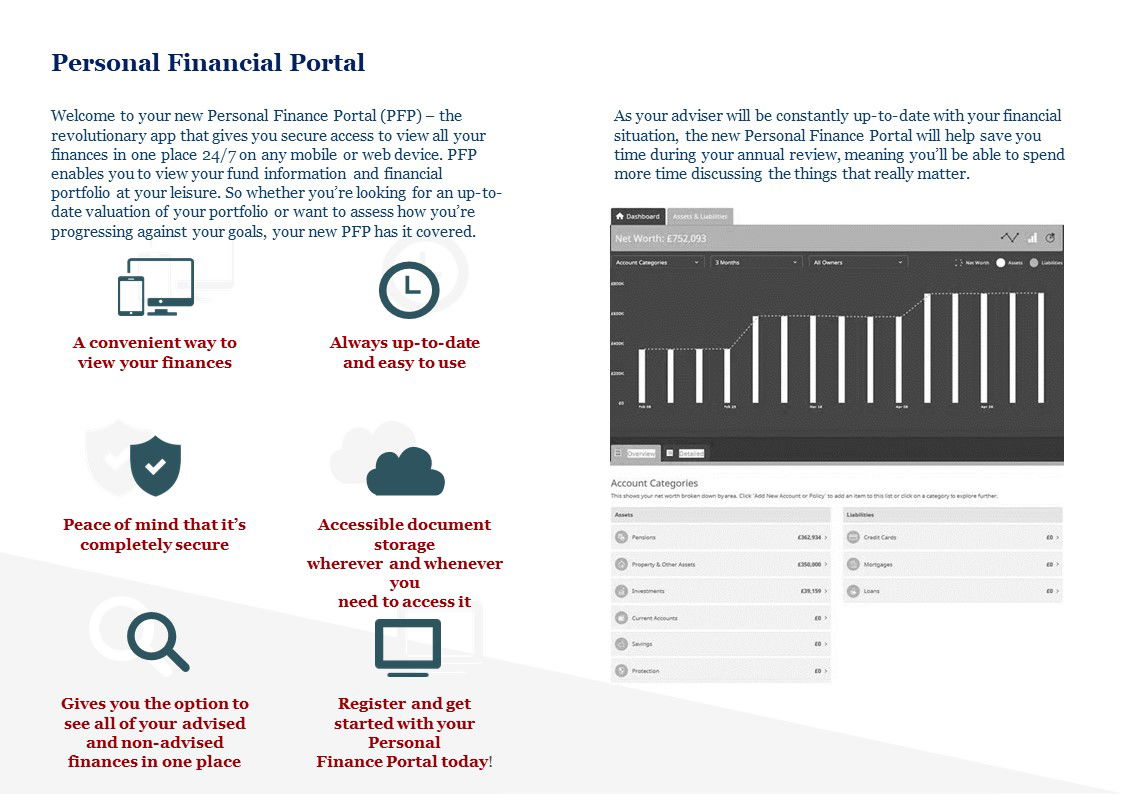

PERSONAL FINANCE PORTAL (PFP)

The Personal Finance Portal gives our clients an invaluable tool on which to view financial information and interact via a secure, online 'hub' anywhere and on any device.

Benefits to our clients include:

- Supports regulatory requirements for information security by providing secure messaging between us

- Allows our clients to view fund and portfolio details, get valuations and assess progress against investment goals

- With Open Banking our clients can link bank accounts to the portal being in control of financial data

- Makes client servicing cheaper by saving processing time, postage and printing costs

- Strengthen relationships

- Provides secure, online storage for all those important documents

- It provides excellent communication, by using one or more of Messaging, Voice, and Video. During this engagement, we will be able to see exactly what you are seeing with CoBrowsing and, with your permission, will be able to take control of your mouse if you wish to have something explained or demonstrated and also share our screen

- Provides peace of mind, knowing that communication is timely and secure

- Available for our clients 24/7 on a desktop, laptop, tablet and mobile phone

For access and registration using a desktop device click on the image below:

For access and registration using a mobile device follow the instructions below:

It is easier than visiting the app stores. You will need to visit the PFP homepage https://www.professionalcapital.gb.pfp.net from your mobile device and you will see a "Get the app" button. Clicking this button will either install the app directly or show you the instructions to install (depending on your browser) which will then add the PFP app icon alongside your other apps. Please note that iPhone users will need to use the Safari browser to add the app. Android users can install it in Google Chrome. To install, follow the instructions and add the link to your home screen, so you do not have to type the PFP homepage address every time you want to access your personal portal.

CLIENT DATA CAPTURE PORTAL

Capturing client data is an important – arguably one of the most important elements of financial planning. We believe you should be proactively involved in your financial affairs. Involving you in the financial planning process with a data capture form (fact find) has tremendous benefits. Not only you will enjoy participating in the financial planning process by doing some of the work, but also the data you provide become far more accurate.

The Client Data Capture Portal is a secure location to communicate and securely share important information about you to enable us to provide best advice, and because this is a digital location, it means it can all be done remotely and when most convenient. All information entered into the Portal will be stored in an encrypted format using AES-256. This is the accepted industry standard for securely storing data.

Should your situation changes you can return to your personal portal to record all changes so we always have an up to date picture of your financial & personal situation.

Already registered? Click here to login to Client Data Capture Portal

CASH MANAGEMENT PORTAL

Benefits to our clients include:

The Platform enables our clients to very quickly ascertain the best value they can receive from their cash deposits.

- Identify the value of one's cash and produce a generic report within 30 seconds

- Build a bespoke portfolio of cash deposits, and produce a specific report, within minutes

- Ensure all deposits obtain the maximum level of FSCS protection

- Issue application forms within seconds of producing a bespoke portfolio

- Communicate securely with with us regarding savings

- Produce diary management notifications on maturing savings accounts

- Produce financial strength reports on banks and building societies

- Use savings calculators

- Produce savings accounts reports for us

- Remove interference from banks and building societies

- In short, the platform enables our clients to take FULL CONTROL of their finances

- The savings accounts offered by UK based banks and buildings societies' are reviewed every 30 minutes to continually identify the best savings accounts to be used within the system

- The platform automatically builds the most effective portfolio of savings accounts to meet our client's requirements

To log into our Cash Management Platform click on the image below: