Time is a powerful ally when it comes to building wealth (FEB 2020)

Investing in the stock market can be very rewarding. However, as share prices fluctuate, it is also possible that you can lose money. This can particularly be the case when you react to short-term stock market falls. This is why our goal based planning philosophy strongly recommends that investors should link their investments with lifetime goals, which could be short, medium or longer term and as such, the longer the investment horizon the more chance there is to build wealth and meet life objectives.

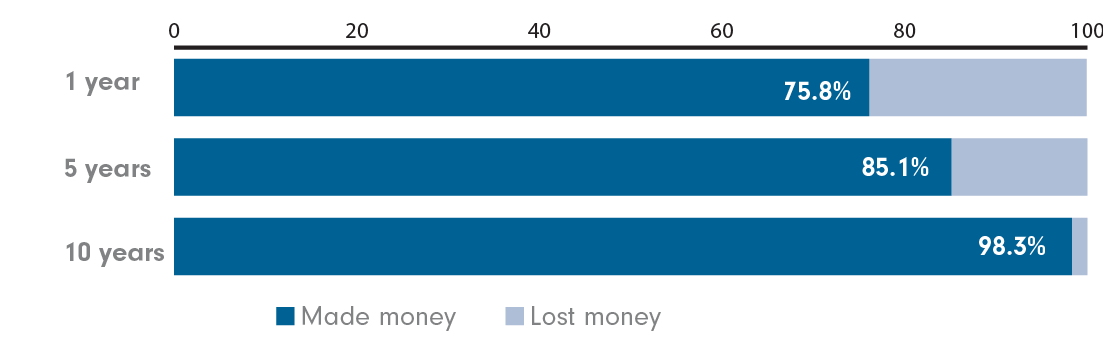

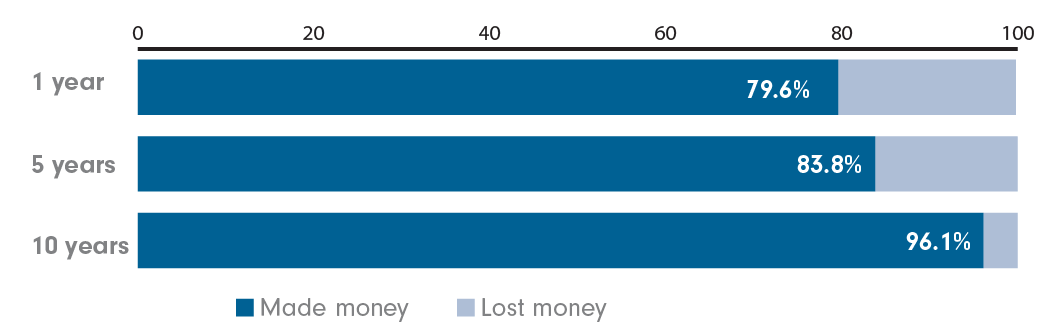

This conclusion is supported by history. Fidelity Investments have looked back over the last 25 years to see how you would have fared by investing in the UK and international stock markets. They analysed how many times you would have made and lost money over one, five and ten years. As you can see, if you held your UK shares for one year only, you would have lost money in more than 20% of instances. However, if you held your UK shares for ten years, you would have lost money in fewer than 2% of instances and if you held money in international shares over the same ten year period you would have lost money in less than 4% of instances. So, putting time on your side really does work.

FTSE All Share Index (UK Shares)

Source: Datastream from 31.12.09 to 31.12.19, FTSE All-Share on bid-bid basis with net income reinvested

MSCI World Index (International Shares)

Source: Datastream from 31.12.09 to 31.12.19, MSCI World on bid-bid basis with net income reinvested.

- Stock markets are prone to short-term fluctuations

- Investors should typically have at least a five-to-ten year time horizon

- The longer you stay invested, the greater chance you have of making money

Index Performance

The table below shows annual returns over each of the last five years from two key indices-The FTSE All-Share and MSCI World.

Source: Datastream from 31.12.14 to 31.12.19, on bid-bid basis with net income reinvested. Please note that past performance is not a reliable indicator of future returns. The value of investments can go down as well as up, so you may get back less than you invest. Changes in currency exchange rates will affect the value of any overseas investments.

The value of advice

This information is not a personal recommendation for any particular investment. When making decisions about investing, we spend considerable amount of time teaching our clients the important principles of investing before we design their asset allocation and investment & risk policy. We work very closely with our clients so we understand their needs and, then offer tailor-based advice to help achieve their long-term goals.